Cryptocurrency may seem like it’s not beholden to geographical borders, but the logistics of cryptomining — and the energy it requires — make location an important factor in the crypto economy.

Location matters. With the world becoming more and more digital we tend to believe that the effects of location are lessening. The same thought about anonymity occurred when the internet, specifically the web, started to become mainstream. The iconic comic “On the Internet, nobody knows you’re a dog” no longer applies with the advent of social media. Location is next: while the internet allows us to communicate with people across the globe this has only highlighted the importance of location.

Cryptocurrency has promised to democratize and decentralize money. What is missed in this argument is that the infrastructure needed to validate cryptocurrency transactions is vast and must be located somewhere. But where is this infrastructure, who controls it, and what happens when it’s turned off?

Listen to NeedleStacks's VPNs, Incognito, free Wi-Fi, oh my! podcast episode.

How is cryptocurrency mined?

When a financial transaction occurs, that transaction must be validated for money to be exchanged by two parties; for example, when you buy groceries, the grocery store relies on a credit card processor to verify that your card has enough funds available for the purchase. This process happens in a few short seconds.

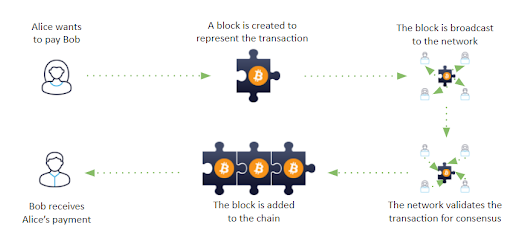

When you make a purchase with cryptocurrency, that transaction isn’t validated by a credit card processor. Instead, it’s broadcasted to the internet and validated by essentially random computers. These computers could be anywhere in the world. When the transaction is validated a new “block” or transaction is added to that cryptocurrency’s block chain. The computer(s) — thus its owner(s) — who successfully validated the transaction are awarded a small amount of cryptocurrency for their efforts.

This is the process of cryptomining and is similar to transaction fees charged by credit card processors.

How blockchain works

Cryptomining requires energy — a lot of it

Mining for cryptocurrency isn’t without its problems. In order to mine cryptocurrency, or validate transactions, a computer must solve an extremely complex math problem. This effort requires significant computing resources and, because computers at their core are pushing electrons back and forth, this requires a significant amount of electricity.

According to the Cambridge Center for Alternative Finance (CCAF), in December 2021 bitcoin mining consumed 10.29 terawatt-hours (TWh) of electricity. This represents 0.54 percent of total global consumption and roughly equates to electricity consumption for lighting and televisions in the U.S. An average bitcoin transaction consumes about 1,700 kilo-watt hours (kWh) of power, or about 60 days of power consumed by an average U.S. household. Given that there are roughly 240,000 bitcoin transactions daily, a day of bitcoin mining equates to a day of power for 14.4 million U.S. households.

In addition to access to electricity, cryptomining requires access to the internet to receive the latest broadcasted transaction blocks. As internet accessibility varies country-to-country and is influenced by current events, this can present a problem to the cryptocurrency economy.

Geopolitics’ impact on cryptocurrency

When geopolitical unrest occurs, one of the first moves by ruling governments is to shut down internet access. This reality allows for authoritarian governments to turn off parts of the internet infrastructure relied on by the global cryptocurrency economy.

Kazakhstan

In September 2021 China issued a total ban on all cryptocurrency transactions and mining, calling these activities “illegal.” As a result, mining in China went dark, and Kazakhstan became the world’s second-largest country for bitcoin mining, behind the U.S.

Why Kazakhstan of all places? Because coal is abundant, thus producing some of the world’s cheapest electricity.

For comparison, in June 2021, 1 kWh of electricity cost $0.370 in Germany on the high side and about $0.002 in Sudan on the low side. In the U.S., 1 kWh costs $0.153 and $0.90 in China, whereas 1 kWh in Kazakhstan costs $0.042. As a result, large data farms have been built in Kazakhstan to mine bitcoin and earn transaction fees. How significant is this? Kazakhstan expects to earn $1.5 billion from cryptocurrency mining over the next five years. Doesn’t sound like much on a global scale, but consider that Kazakhstan’s GDP in 2020 is estimated at about $171 billion. Comparatively, if the U.S. mined an equivalent percentage of GDP, this would equate to $192 billion in transaction fees or more than agriculture’s portion of the U.S. GDP.

On January 2, 2022 protests began in Kazakhstan over the price of liquefied gas. The protests grew to a point where on January 4, 2022 the government turned off the country’s access to the internet. This was targeted at organized protests, but caused a complete halt of cryptomining in Kazakhstan. This halt reduced the global bitcoin hashrate by 12 percent. (Note: hashrate is a measure of computing power needed to support a cryptocurrency network.)

This significant reduction in the hashrate decreases the speed at which bitcoin transactions can be verified. Until a transaction is verified, funds do not change hands. Imagine purchasing groceries and the time it takes to process your credit card takes 10 percent longer. You may think “that’s no big deal,” but remember when credit cards went from magnetic stripes to chips, and we all complained about the extra second or two? Although the bitcoin network is designed to account for changes in hashrates, these adjustments are not instantaneous and can take a few weeks to occur.

Location matters

The world is getting smaller. Events on one side of the world used to take years, then months, then weeks to affect someone on the other side. With cryptocurrency and other digital assets being managed in countries across the world, a protest over an unrelated issue can result in an internet shutdown that immediately affects financial transactions worldwide. The stability of digital assets — and potential world commerce — are greatly affected by where those digital assets are processed. In a decentralized currency, location matters.

In online research, location matters a lot. That’s why Authentic8’s Silo for Research platform provides egress locations from around the world. Leveraging this global network, you can appear to be browsing from an appropriate location based on the subject of your investigation. This is important, even when conducting research in the non-physical world, such as with cryptocurrency. Learn more here.

Tags Cryptocurrency OSINT research